- -27%

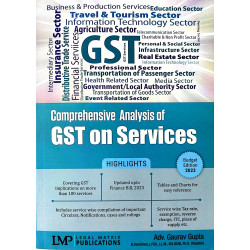

Comprehensive Analysis of GST on Services By Gaurav Gupta

Comprehensive Analysis of GST on Services, by Adv. Gaurav Gupta, is a service wise commentary of GST implications on more than 100 services including Education Sector, Travel and tourism sector, Construction sector, government sector etc. The Book provides a comprehensive overview of GST implications on each service. The Book aims to act a ready reference for reader to find all issues and their resolutions relating to a particular service at one place including but not limited to taxability of such service, Exemptions, Liability to pay, Time of supply, Place of Supply and even import and export conditions in a precise and concise manner. Chapter 1 of the book provides many easy-to-use charts and tables for ready reference on many concept and compliances including concept of Supply, liability pay, exempt services, due dates, reverse charge Adv. Gaurav Gupta etc. The book contains easy references and lucid writing to bring forth all concepts in the manner which is comprehensive yet easy to understand. This book aims should act as a ready reference for GST implications on services for tax practioners, students, CFOs and also departmental officers. Find out answers to issues like

Readers shall also get regular updates from author. We wish a happy reading to our readers and invite suggestions to improve any Chapter or elaborate the same as per the requirements of our readers.

Chapter 1 – Introduction to GST

Chapter 2 – Classification of Services

Chapter 3 – Services relating to Construction Sector.

Chapter 4 – Finance Sector

Chapter 5 – Charitable and Non-Profit Sector

Chapter 6 – Transportation of Goods Sector…

Chapter 7 – Transportation of Passenger Sector…

Chapter 8 – Support Services in Transportation

Chapter 9 – Health Related Sector

Chapter 10 – Accommodation and Food serving

Chapter 11 – Travel and Tourism Sector

Chapter 12 – Personal and Social Sector.

Chapter 13 – Insurance Sector

Chapter 14 – Renting Sector….

Chapter 15 – Professional Sector….

Chapter 16 – Event Related Sector…

Chapter 17 – Media Sector

Chapter 18 – Information Technology Sector

Chapter 19 – Job Work Services

Chapter 20 – Business Related Sector

Chapter 21 – Infrastructure Services

Chapter 22 – Telecommunication Sector.

Chapter 23 – Agricultural Sector

Chapter 24 – Education Sector

Chapter 25 – Services by Government/ Local Authority.

Chapter 26 – Commerce Operator and OIDAR

Chapter 27 Input Service Distributor and Cross Charge.

ANNEXURES

Notification No. 11/2017-Central Tax (Rate), Dated 28-6-2017

Notification No. 12/2017-Central Tax (Rate), Dated 28-6-2017.

Subject Index